Investing In Opportunity Zones

Business Facilities

AUGUST 29, 2022

As part of the 2017 Tax Cuts and Jobs Act, Qualified Opportunity Zones across the U.S. provide a vehicle to reinvest capital gains for near- and long-term tax benefits.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Business Facilities

AUGUST 29, 2022

As part of the 2017 Tax Cuts and Jobs Act, Qualified Opportunity Zones across the U.S. provide a vehicle to reinvest capital gains for near- and long-term tax benefits.

BD+C

APRIL 7, 2019

The Tax Cuts and Jobs Act of 2017 created the designation “Opportunity Zone,” for which the Internal Revenue Service will allow tax advantages for certain investments in lower-income areas when an Opportunity Fund invests more than 90% of its assets in a zoned property.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Construction Marketing

JANUARY 25, 2023

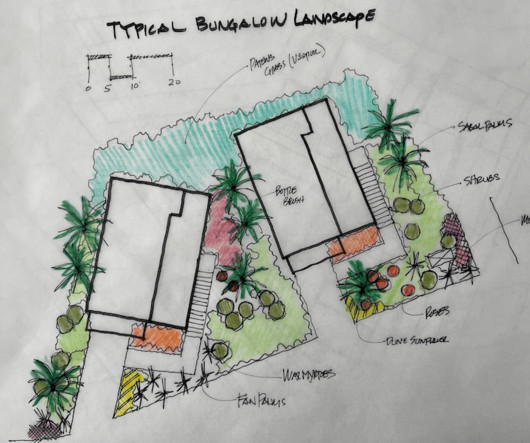

This includes analyzing factors such as zoning regulations, transportation access, and market demand. After acquiring the property, the developer must design and plan the project, considering factors such as building codes and zoning regulations, the intended use of the property, and the target market.

BD+C

MAY 23, 2019

The plan relaxes zoning restrictions and provides incentives for higher density construction in affordable and mixed-income developments. To qualify, 50% of the housing in a development must be affordable—priced for families earning 60% or less of median family income (MFI) for the area.

Pro Builder

OCTOBER 6, 2021

Can Single-Family Zoning Be Meaningfully Reversed? Single-family only zoning has long been the smart bomb NIMBYs and municipalities used to keep out developments that would add density, multifamily, and “those people” of a different race, ethnicity, or class from moving into their neighborhoods. Wed, 10/06/2021 - 10:19. Affordability.

Pro Builder

SEPTEMBER 17, 2021

A recent Realtor.com report found buyers put down 21% of their household income before taxes toward monthly mortgage payments in May. share of income over the past decade, but remains within the affordable range. The affordability zone for housing is anything less than 30% of the buyer's income.

BD+C

APRIL 19, 2019

Treasury Department and the Internal Revenue Service released new regulations and guidelines for investments in the 8,700 distressed or lower-income census tracts that governors across the country have designated as Opportunity Zones (OZs).

Pro Builder

JULY 11, 2022

Zoning Regulations Pose Challenges for Regional Builders, but Three Female-Led Projects May Help. These trailblazing women are digitizing zoning codes and regulations to help builders create more affordable housing. Mon, 07/11/2022 - 10:22.

Viewpoint Construction Technology

FEBRUARY 14, 2019

Dreyfus noted that construction companies should be planning ahead — both in terms of taking advantage of incentives like investing/building in specially designated Qualified Opportunity Zones throughout the country and taking advantage of tax credits like 179D and R&D, and preparing their companies to weather economic downturns.

BD+C

OCTOBER 20, 2023

million homes that are accessible to low-income renters. Nationwide, 60% of all workers earn less than what’s required to afford a two-bedroom rental home, according to a June report by the National Low Income Housing Coalition, which also cited the shortage of affordable housing.

Pro Builder

FEBRUARY 24, 2023

That light density increase is something that is usually all but nonexistent in post war neighborhoods with single-family zoning. How One Nonprofit Housing Developer in Roanoke, Va., However, Ms.

Buisness Facilities Contributed Content

MAY 22, 2014

It places extra emphasis on spurring development and private-sector job growth in new Garden State Growth Zones (GSGZ) identified in the legislation as the four lowest median family income cities in the state: Camden, Trenton, Passaic and Paterson. The new law builds on Christie’s commitment to revitalizing New Jersey’s cities.

Green Building Law Update

JANUARY 8, 2017

New York City Zone Green thick wall exclusion allows for up to 8 inches of wall thickness to be exempted from the calculation of floor area to encourage high performance buildings without decreasing the amount of usable space in the building, including Passive construction.

Pro Builder

NOVEMBER 5, 2020

Richmond-based builder Center Creek Homes only launched two years ago, but is making waves in the city by building low-income housing. The most recent build takes land previously zoned for two single-family homes and will now house five smaller attached homes.

Pro Builder

FEBRUARY 2, 2022

Suburbs are sprawling again, but a lack of buildable residential land is pushing lower-income Americans out of the housing market. Current zoning laws date back to 1930s-era guidelines from the Federal Housing Administration, but modern-day housing stretches beyond just single-family lots and requires additional land for multifamily units.

BD+C

DECEMBER 14, 2023

We expect current trends of providing wraparound services at the lowest-income levels and for special needs groups to continue. However, at more moderate-income levels and in smaller buildings, we’re seeing fewer dedicated amenities. And how are people responding?” Looking Beyond the Building. The results thus far are mixed.

Buisness Facilities Contributed Content

JANUARY 28, 2014

California is considered by critics as one of the hardest states in which to grow a business, given its high individual and corporate income tax rates, high sales tax, and conflicting regulations. The San Diego Enterprise Zone, which ended Dec. 31, currently consists of areas of South County, southern San Diego and Rancho Bernardo.

Pro Builder

MAY 1, 2023

offer buyers a turnkey option akin to a luxury hotel suite—one that's also an investment that can generate rental income. This little section of Kiawah River is zoned for short-term rentals, so the homes are designed to be perfect for two or three-night stays,” Drury says. These are high-end homes, sold fully furnished.

Pro Builder

DECEMBER 10, 2021

ordinance allows separate accessory dwelling units in all single-family zones, and in an effort to create more affordable housing, the town is also permitting homeowners to sell units separately from a primary residence as condominiums, The New York Times reports. . Homeowners in Princeton, N.J. In Princeton, N.J., a relatively new A.D.U.

Buisness Facilities Contributed Content

APRIL 18, 2013

The city has created two Tax Increment Financing Districts with a third in process, to expand the municipal infrastructure to industrial and commercial zones. The city has adopted three NH Economic Revitalization Zones, offering corporate tax credits to qualifying businesses.

Wolgast Corporation

JANUARY 12, 2023

Some owners believe that they have to shut down for a length of time and go without income, risking their staff leaving and being burdened by ongoing bills. A restaurant owner may need to update their restaurant because it’s no longer functioning well, it’s required by their franchisor, or they are just seeking an updated look.

Pro Builder

JANUARY 25, 2022

The most popular solution to ease housing affordability woes, cited by 66% of the survey respondents, would be to provide incentives to private builders and developers to create more affordable housing for low- and moderate-income households.

HardHatChat

NOVEMBER 24, 2015

Likewise, many local and regional brands will capitalize on consumers having more disposable income for entertainment, and actively look for opportunities to expand outside their hometown market. Developers and Tenants Create Entertainment Zones to Drive Traffic.

Pro Builder

DECEMBER 2, 2021

Opposing cities like Los Altos Hills, Cupertino, Pasadena, and Redondo Beach are rushing to pass regulations limiting size and height of new development, mandating parking spots, and requiring that multi-unit housing be rented only to those making moderate or low incomes. “We Housing Policy + Finance. Construction. Housing Policy + Finance.

Buisness Facilities Contributed Content

MARCH 6, 2016

Requirements: Obtain commitment from local government to provide local incentives and establish an Economic Development Zone. Enterprise Zones: Under the program, certain types of businesses locating to, or expanding in a designated zone may claim state income tax credits provided in the law.

Pro Builder

JUNE 1, 2023

million housing units for low-income renters, according to the National Low Income Housing Coalition. Rather than building inexpensive units, those developers are adding a large share of luxury condos due to higher demand and bigger profits, Forbes reports. is short 7.3 In pricey coastal markets, residential land is expensive.

Business Facilities

JULY 24, 2019

Tennessee is proud to be a right-to-work state with no personal income tax on wages. OPPORTUNITY ZONES ARE HERE. The authors of the Opportunity Zones section of the tax reform bill, Sen. North Carolina, Colorado and Virginia topped the chart in BF’s flagship Economic Growth Potential ranking. that need it the most.

Pro Builder

MARCH 16, 2023

Trust Neighborhoods has created a new, innovative approach to tackle affordable housing: the Mixed-Income Neighborhood Trust, or MINT, that owns and operates a portfolio of rental housing under community control to maintain permanent affordability. zoning codes through a first-of-its-kind user-friendly online resource.

Lets Build

JULY 11, 2017

The Lien Zone. Construction Zone Radio. This podcast gives a lot of useful information how to gain new management and business skills for a better income and work structure. A great collection of podcasts created by Devon Tilly and Kevin Keefe, president and manager of Mountain View Window &Door. Constructrr.

Pro Builder

APRIL 20, 2021

Using equipment such as solar-tracking photovoltaic panels, an energy-recovery ventilator that reuses exhaust heat from the home’s appliances, and highly efficient air conditioning through zone-based ductless mini-split heat pumps, the home generates an estimated 321 kilowatt-hours of excess electricity that is stored in on-site batteries.

Business Facilities

JULY 11, 2014

The intention is to protect those industrial lands with the potential for future economic development and job growth from conversion to residential or commercial zoning. In addition, some zones can offer special incentives for investments in long-term rural facilities or electronic commerce operations.

Buisness Facilities Contributed Content

SEPTEMBER 26, 2013

Over the last two years, Florida has eliminated thousands of regulations on job creators and removed corporate income taxes for thousands of small businesses. Less Taxing” since there is no state income tax. According to the 73rd Annual Report released by the Foreign-Trade Zones Board to the U.S. People can also enjoy “Life.

Business Facilities

AUGUST 23, 2017

While the national average of per-capita income going to taxes is 9.9 In addition, Arizona’s taxes on property, gas and personal income remain low compared to the rest of the country. Zoned mixed-use/commercial. Strong workforce within a 45 minute commute zone. Strong workforce within a 30 minute commute zone.

Pro Builder

SEPTEMBER 28, 2022

As such, obtaining a permit requires the homeowner to inform neighbors of the project and allow for public input at a zoning board meeting. The result: Not a single comment was sent to the town hall, and nobody appeared at the zoning board’s Zoom meeting to air their views on the proposal, good or bad. . Explain zoning issues.

Pro Builder

FEBRUARY 3, 2021

Americans Agree on Strict Building Codes for Fire, Flood Zones. A permanent minimum 4% credit floor on low-income housing tax credits enables NAHB multifamily developer members to finance thousands of additional affordable rental units. . NAHB New Chair to Tackle Regulation and Promote Trades.

Pro Builder

JANUARY 6, 2021

Counties deemed unaffordable are those with housing costs exceeding 28% of the average household income. The largest metros where homeownership remains affordable on average are Chicago, Houston, Philadelphia, Cleveland, and Tampa. .

Pro Builder

AUGUST 26, 2021

Supporters say this is a good way to add affordable homeownership opportunities in traditionally high to middle-income areas but naysayers think it’s financially inaccessible for most homeowners. of Realtors as a way, it said, to limit developers and gentrification in lower-income communities of color. Read More. . Housing Markets.

Pro Builder

JANUARY 22, 2021

Purchasing a tiny home could be both a cheaper way to buy, but also a way to generate more income since they can be rented out. Builders usually incorporate materials that align with the main house, as zoning rules tend to require. The growing interest could be due to the rising cost of living, especially for cities on the West Coast.

Buisness Facilities Contributed Content

MARCH 9, 2016

The Award is based on two years (at full operation) of estimated incremental personal income taxes that the state would collect from new employees at the above pay scale. In an enterprise zone, most authorized businesses enjoy a somewhat broader tax abatement using a different form. The maximum available to an applicant is $50,000.

Pro Builder

SEPTEMBER 29, 2022

A more efficient conditioned air distribution system optimizes zoned heating, cooling, and fresh-air ventilation equipment for ideal indoor comfort. ton variable refrigerant flow (VRF) zone-controlled heat pump system to provide space heating and cooling. Desert Comfort: Next-Gen HVAC and Indoor Air Quality. Wed, 09/28/2022 - 12:05.

Buisness Facilities Contributed Content

JANUARY 27, 2014

A key component of the Urban Outfitters deal was the use of Pennsylvania’s Keystone Opportunity Zone (KOZ) incentive program, created in the 1990s to lure new and expanding businesses to the state.

Pro Builder

AUGUST 19, 2021

Utility hookups and local zoning laws can add more to the price tag too. “If Tiny homes there cost less than half the average annual household income. They even cost 87% less than a typical home, averaging $52,000, but the cost per square foot is where it gets tricky. Tiny homes are least affordable in Hawaii, Montana and New Mexico.

Buisness Facilities Contributed Content

MARCH 9, 2016

Business Development Tax Credit: Provides refundable income tax credits that can be earned based on jobs, capital investment, training and the location or retention of corporate headquarters. Historic Preservation Tax Credit: State income tax credit for 20% of the qualified rehabilitation expenditures for eligible buildings.

Pro Builder

OCTOBER 5, 2020

Rather than density, floor-to-area ratio, lot coverage and other zoning formulas, Parolek’s analysis focuses on design characteristics such as height, shape (form), unit layout, and ideal building dimensions.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content